BTC Price Prediction: Analyzing the Path to $180,000 Amid Current Market Conditions

#BTC

- Technical indicators suggest oversold conditions with potential bounce to $116,600 resistance level

- Institutional adoption continues accelerating despite short-term geopolitical headwinds

- Long-term price targets remain bullish with VanEck predicting $180,000 by year-end

BTC Price Prediction

Technical Analysis: BTC Shows Oversold Conditions with Potential Reversal Signals

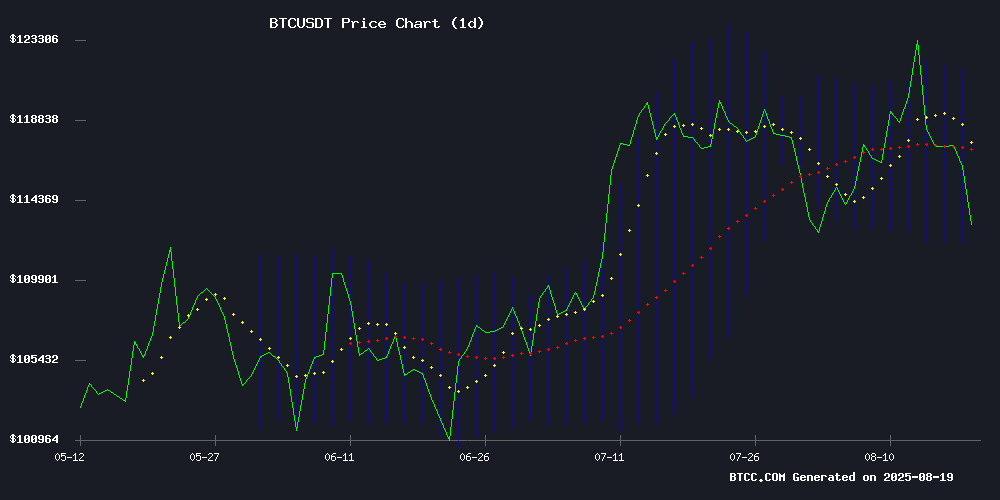

BTC is currently trading at $113,447, below its 20-day moving average of $116,606, indicating short-term bearish pressure. The MACD reading of -1,224 suggests ongoing downward momentum, though the histogram shows some convergence. Prices are hovering NEAR the lower Bollinger Band at $111,518, which often acts as support. According to BTCC financial analyst William, 'The technical setup suggests BTC is oversold and may be due for a bounce toward the middle band around $116,600 if broader market sentiment improves.'

Mixed Market Sentiment: Institutional Demand Grows Amid Geopolitical Headwinds

Recent headlines present a complex picture for Bitcoin. Positive institutional developments include BlackRock accumulating 3.7% of Bitcoin's supply and VanEck's bullish $180,000 year-end prediction. However, geopolitical tensions and mining difficulty increases are creating headwinds. BTCC financial analyst William notes, 'While institutional adoption continues to accelerate, short-term price action remains sensitive to macro factors and Fed policy expectations. The record mining difficulty suggests long-term network strength despite current price pressure.'

Factors Influencing BTC's Price

Bitcoin Mining Difficulty Hits Record High Amid Revenue Squeeze

Bitcoin's mining difficulty surged to an unprecedented 129 trillion, compounding challenges for miners already facing compressed revenues. The network's self-adjusting mechanism pushed difficulty 6.4% higher over three months, nearing June's 126 trillion peak. Miner economics deteriorate as hashprice plunges to $60 per petahash and transaction fees dip below 1% of block rewards—a historic first.

Regulatory headwinds exacerbate pressures. New tariffs of up to 57.6% on mining imports threaten operators like CleanSpark ($185M exposure) and Iris Energy ($100M liability). While difficulty may ease 0.33% in the August 22 adjustment, the current climate underscores Bitcoin's unforgiving arithmetic: higher security demands lower margins.

Bitcoin Struggles Below $116,000 Amid Geopolitical Tensions

Bitcoin's price has dipped below $116,000, marking a 6.8% decline from its recent all-time high of $124,474. The drop is attributed to heightened geopolitical uncertainty, particularly following remarks by U.S. President Donald Trump about potential trilateral negotiations involving Russia and Ukraine.

Despite the downturn, institutional investors like Metaplanet continue accumulating BTC, viewing the pullback as a buying opportunity. Their sustained confidence contrasts sharply with short-term holders, who are now realizing losses after seven consecutive months of gains.

The market faces a critical juncture - whether this correction represents a healthy reset or the beginning of a prolonged bearish phase. Trading volumes remain robust across major exchanges including Binance and Coinbase, suggesting active repositioning by market participants.

VanEck Predicts Bitcoin to Reach $180,000 by Year-End Amid Bullish Market Signals

VanEck's latest report forecasts Bitcoin surging to $180,000 by December 2025, citing strong futures market activity and record-high U.S. mining dominance. The analysis highlights a 9% CME basis funding rate—the highest in six months—and a 3.21x call/put ratio, reflecting escalating institutional demand.

Bitcoin ordinals minting has doubled since 2024, coinciding with protocol upgrades removing arbitrary block data limits. Meanwhile, mining companies face declining mNAV as volatility subsides, a trend VanEck expects to persist despite BTC's price momentum.

Google's $3.2B Bitcoin Miner Bet Sparks 72% Rally in Terawulf Shares

Terawulf Inc. shares surged 72% in five days after Google acquired a 14% stake through a $3.2 billion leaseback deal tied to the company's Lake Mariner data center campus. The arrangement positions Google as Terawulf's largest shareholder while securing lease obligations for Fluidstack, an AI infrastructure provider.

The transaction marks a strategic pivot for Terawulf, shifting focus from Bitcoin mining toward AI and computing services. Google's involvement creates rare institutional exposure to cryptocurrency infrastructure, with the tech giant simultaneously advancing its artificial intelligence capabilities.

Market reaction highlights growing investor appetite for crossover plays between digital assets and emerging technologies. The deal structure—using lease-backed warrants—demonstrates sophisticated financial engineering in the crypto mining sector.

Bitcoin Holds Key Support Amid Bearish Signals, Potential Bounce Ahead

Bitcoin trades near $113,413 as the $111,500–$112,500 zone emerges as a critical demand area. A rejection at $124,000 has kept BTC rangebound, with a breakout above this level required for sustained upside momentum.

Daily charts reveal a five-day bearish engulfing pattern and a wedge breakdown, signaling fading bullish strength. Analysts caution that a weekly close below $114,000 could pave the way for a drop toward $109,000. Yet, the market shows potential for a transition into a bullish ascending triangle formation.

Trading volume stands at $69.85 billion over 24 hours, with Bitcoin's market capitalization holding at $2.26 trillion. The cryptocurrency maintains 58.88% market dominance despite a 2.06% price decline in the past day.

Franklin Templeton CEO Advocates for Crypto Infrastructure Over Bitcoin as Primary Investment

Jenny Johnson, CEO of $1.6 trillion asset manager Franklin Templeton, argues that the true value in crypto lies not in Bitcoin but in the underlying infrastructure supporting blockchain technology. Speaking at the SALT conference in Jackson Hole, she labeled BTC a "fear currency"—useful in unstable economies but ultimately a distraction from the sector's transformative potential.

"The picks and shovels are the baseline of strong, layered apps," Johnson said, emphasizing blockchain networks and validation systems as prime investment targets. Her focus aligns with institutional interest in foundational protocols rather than speculative assets.

While acknowledging Bitcoin's role as a hedge against currency devaluation, Johnson positioned it as secondary to the "greatest disruption coming to financial services"—the rails enabling decentralized applications. Validators and consumer-facing apps built on robust infrastructure emerged as her top picks for capital allocation.

Bitcoin Faces Key Test Amid Fed Watch and Geopolitical Uncertainty

Bitcoin's rally to a record $124,474 last week has given way to a 7% pullback, with the cryptocurrency now consolidating near $115,000. Technical indicators paint a mixed picture: the RSI at 44 signals bearish pressure, while the MACD's recent crossover reinforces downside risks. A close below the 50-day EMA at $115,046 could open the door to $112,000.

Market participants are closely monitoring the compression between Bitcoin's rising trendline and resistance at $116,855. A decisive breakout here could reignite momentum toward the $119,300-$120,000 zone. 'The 1D MA50 rebound and pivot trendlines suggest the makings of a new bullish leg,' notes TradingShot's analysis on TradingView.

Bitcoin Market Balances Out as Old and Young Coins Hold Steady

Bitcoin hovers near $115,000 after failing to sustain momentum above $120,000. The market shows equilibrium between short-term traders and long-term holders, with no dominant speculative pressure. A consolidation phase suggests base formation before the next decisive move.

Short-term holders face increasing pressure as BTC tests key support levels. Historical patterns suggest such breakdowns often trigger volatile swings before trend reversals. On-chain metrics, including the HODL Structure and 30-Day Flows chart, reveal shifting capital flows among investor cohorts.

KindlyMD's $679 Million Bitcoin Treasury Move Sparks Stock Plunge

Healthcare firm KindlyMD has pivoted sharply into cryptocurrency, announcing a $679 million Bitcoin purchase through subsidiary Nakamoto Holdings. The 5,743 BTC acquisition at approximately $118,205 per coin marks one of the largest corporate treasury allocations to date.

Market reaction proved punishing—KindlyMD's Nasdaq-listed shares (NAKA) tumbled 13% to $10.41 following the disclosure. The decline contrasts with CEO David Bailey's bullish stance: "This reinforces Bitcoin as the ultimate reserve asset for corporations."

The transaction coincides with Bitcoin's 5% weekly pullback from record highs above $124,000. Bailey, who previously advised the Trump administration on crypto policy, engineered KindlyMD's May merger with Bitcoin-focused holding company Nakamoto.

BlackRock Amasses 3.7% of Bitcoin Supply as Institutional Demand Surges

BlackRock's iShares Bitcoin Trust (IBIT) now holds 740,000 BTC, representing 3.72% of Bitcoin's total supply. This positions the asset manager as the second-largest single holder of BTC globally, trailing only the estimated holdings of Bitcoin's pseudonymous creator Satoshi Nakamoto.

Institutional accumulation continues unabated despite market volatility. Corporate treasury additions include Strategy's (formerly MicroStrategy) recent $51.4 million purchase of 430 BTC and Metaplanet's acquisition of 775 BTC at approximately $119,853 per coin. The Japanese firm is emerging as Asia's most prominent publicly traded Bitcoin accumulator.

The institutional custody landscape shows BlackRock's IBIT dominating with $80 billion in assets under management, far outpacing competitors Fidelity FBTC ($24.7 billion) and Grayscale GBTC ($22.18 billion). This widening gap underscores Wall Street's accelerating embrace of cryptocurrency as a core asset class.

Independent Miner Scores $365K Bitcoin Windfall in Rare Solo Feat

Bitcoin mining's evolution from hobbyist activity to industrial-scale operation makes solo victories increasingly exceptional. A lone miner using the Solo CK pool defied 800-to-1 daily odds to solve block 910,440, netting 3.137 BTC ($365,000) - only the 305th such achievement in the pool's history.

The reward structure highlights mining's dual revenue streams: 3.125 BTC from the block subsidy plus 0.012 BTC in transaction fees from 4,913 processed transfers. At 9 petahashes/second, the miner's setup represents significant individual capability in a sector dominated by institutional mining farms.

CKpool operator Con Kolivas emphasized the statistical improbability of such outcomes as Bitcoin's difficulty curve escalates. The event underscores how proof-of-work's meritocratic design still permits individual participation, albeit requiring substantial technical and financial commitment.

Is BTC a good investment?

Based on current technical and fundamental analysis, BTC presents a compelling investment opportunity for risk-tolerant investors with a long-term perspective. While short-term volatility persists due to geopolitical concerns and Fed watching, several bullish factors support the investment thesis:

| Bullish Factors | Bearish Considerations | Price Targets |

|---|---|---|

| Institutional accumulation (BlackRock 3.7% supply) | Geopolitical tensions | Short-term: $116,600 (MA) |

| VanEck's $180,000 prediction | High mining difficulty pressure | Medium-term: $140,000-$160,000 |

| Oversold technical conditions | Fed policy uncertainty | Year-end: $180,000 (VanEck) |

| Strong institutional infrastructure development | Short-term volatility | Long-term: $200,000+ |

BTCC financial analyst William suggests 'Dollar-cost averaging and a 3-5 year horizon may optimize returns given current market conditions.'